The Fort Bend County Municipal Utility District No. 24 (FBCMUD 24) Board of Directors would like to inform residents how property taxes are calculated in Texas.

- Annual Property Valuation

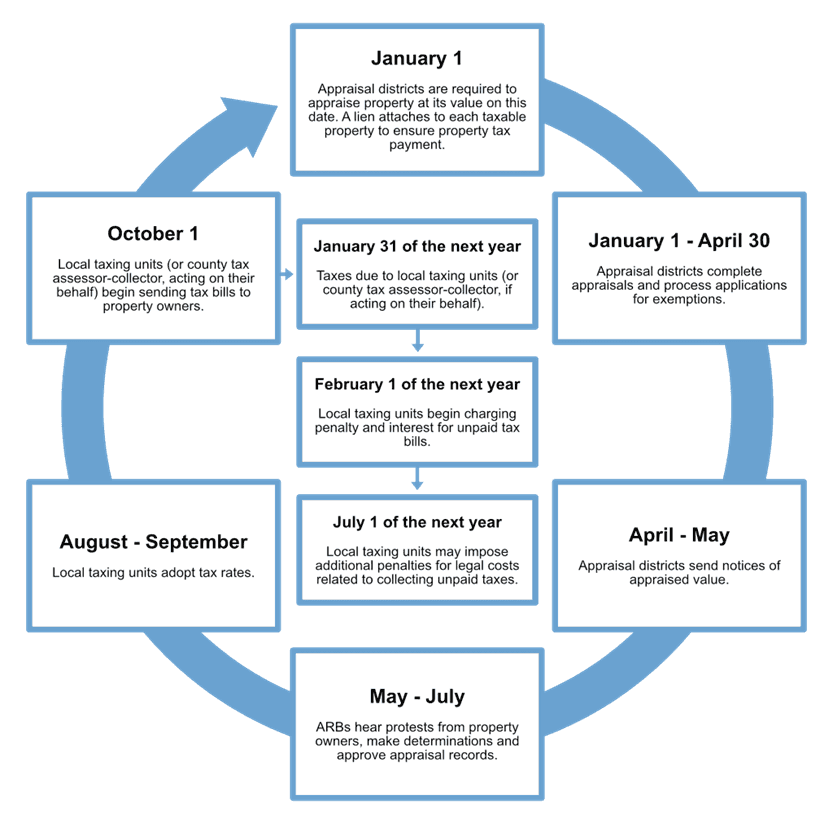

Your property's value is assessed each year on January 1st by the Fort Bend County Appraisal District (FBCAD). This value is used to calculate your tax bill. - Setting the Tax Rate

Once the property values are certified by the County Appraisal District, the Board of Directors for FBCMUD 24 will set the tax rate. They do this with input from financial consultants. - Calculating Your Tax Bill

Your property tax bill is calculated by multiplying your property's appraised value by the set tax rate. - Exemptions

There are various exemptions that may apply to your property, such as the Homestead Exemption for individuals who are 65 or older. - Protesting Your Property Value

If you believe your property’s assessed value is incorrect, you can protest your valuation with the FBCAD. - When You’ll Receive Your Bill

You should receive your property tax bill by the end of October each year. - Payment Deadline

You have until January 31 of the following year to pay your tax bill without incurring a penalty.

Remember:

- Your property's value is assessed every January 1

- You can protest your appraised value if you believe it is too high or too low

- Local entities set their own tax rates

- There are a few exemptions that may apply to you

- You have until the end of January to pay your property tax bill without penalty

Watch this informational video produced by the Association of Water Board Directors to learn more:

Want to share this information with your friends and neighbors? Please click the “Share” button above to post this to Facebook and X/Twitter or copy the link to share to Nextdoor or text/email it out!